Learn about the benefits of lifetime credit cards.

No Joining fee, no annual fee, Credit Limit up to ₹5 Lakhs

The key to achieving financial independence is a credit card that is free for life! Find out what makes it unique, the amazing advantages, and the ways that IDFC First Bank Credit Cards can improve your life. Check out more today to avoid missing out on these fantastic bank offers!

Did you know that credit cards have become very popular in India? The Reserve Bank of India (RBI) recently released data showing that as of April 2023, there were over 8.6 crore credit cards in India, a 15% growth from the year before.

This is due to the fact that credit cards have completely changed the way we manage our finances by enabling safe and convenient transactions. They are now essential for everything from online bill payments and vacation reservations to online shopping and eating out. This is due to the abundance of credit card benefits like cashback, incentives, and discounts.

The lifetime free credit card has been receiving a lot of attention in the midst of this expansion. Let’s investigate why!

What is a credit card that is free for life?

A lifetime-free credit card, sometimes referred to as a zero-fee credit card, is one that has no annual fees for the length of its use. Therefore, you can think about applying for a lifetime free credit card if you’re a first-time cardholder and want to build your credit score without having to pay any further fees.

A lifetime-free credit card’s features

Because of their features, which include the following, these cards are frequently referred to as zero-fee credit cards.

No annual fees

The lack of annual fees is one of the main benefits of a lifetime credit card. Lifetime-free credit cards do not impose an annual usage fee, in contrast to other credit cards that usually do. As a result, you get to take advantage of this card’s perks annually at no extra expense.

No joining fees

Another benefit of lifetime-free credit cards is the absence of enrollment fees. Certain credit card companies may include a one-time joining fee in the application process when you apply for a card. But you can avoid this charge if you have a lifetime free credit card, which lowers your up-front expenses even more.

No renewal fees

Lifetime free credit cards do not impose yearly or joining fees, nor do they impose any renewal costs. When you renew your credit card annually, you don’t have to worry about paying any fees to keep using it.

Benefits of a lifetime-free credit card

Credit cards that are free for life have many benefits that might help you save more money and manage your finances more effectively. The advantages are as follows:

Cost savings for cardholders

One big benefit of lifetime-free credit cards is the lack of annual fees. Each year, you can save a good sum of money by getting rid of this charge.

To give an example, annual fees charged by banks often range from Rs 500 to Rs 2000. However, you can save up to Rs 18,100 annually with IDFC FIRST Bank Credit Cards, which also serve as lifetime free credit cards!

Reward programs and cashback offers

These are just a few of the incredible advantages of lifetime credit cards. Card issuers work with retailers and service providers to deliver exclusive rebates, points, and rewards.

You can earn reward points or cashback by using your lifetime free credit card for regular purchases like dining, shopping, travel, and gas.

EMI conversion

Additionally, you can break up big purchases into manageable equal monthly installments (EMI) using lifetime free credit cards. By avoiding an upfront lump-sum payment, this EMI conversion gives you financial flexibility.

Waiver of fuel surcharge

Certain lifetime-free credit cards, such as those provided by IDFC FIRST Bank, waive a fuel surcharge of 1% of the total transaction amount. It provides a waiver of the fuel station surcharge, allowing you to reduce your gasoline expenses.

Insurance coverage

A number of lifetime-free credit cards also come with insurance coverage, which gives you piece of mind both on and off the road. This includes medical insurance, purchase protection, and travel insurance.

For example, with the FIRST Wealth Credit Card from IDFC FIRST Bank, you get an air accident cover of Rs 1 crore, a personal accident cover of Rs 10,00,000, and a lost card liability cover of Rs 50,000. Additionally, you also receive comprehensive travel insurance coverage worth $1200.

Why choose IDFC First Bank?

Selecting the appropriate bank is essential when choosing a lifetime credit card. The following are some justifications for thinking about IDFC First Bank Credit Cards:

Rate of interest

The initial interest rate on IDFC FIRST Bank Credit Cards is 9% p.a., which is substantially less than the average market rate of about 42% p.a. These lifetime-free credit cards have an annual percentage rate (APR) that is based on a number of variables, such as your credit score, bank connection value, income profile, repayment habits, and other pertinent aspects.

Interest on ATM cash withdrawal

The advantage of having zero interest on ATM cash withdrawals until the next due date is available with IDFC FIRST Bank Credit Cards. They also charge a withdrawal fee of just Rs 199, which is a lot less than what other banks charge.

high compensation

High rewards

With IDFC FIRST Bank, purchases made on your birthday and any additional monthly expenses over a certain level might earn you 10X reward points. Additionally, you can earn 3X reward points for offline purchases and 6X reward points for online purchases for monthly spends up to a certain sum.

Redeeming Reward Points

You can spend your reward points just like cash when you use IDFC First

Bank credit cards. Redeeming your reward points for your subsequent online purchase on sites like Amazon, Yatra, BookMyShow, and others is simple and straightforward. Furthermore, you can use the reward points whenever it’s convenient for you because they don’t expire.

Gaining access to benefits

Joining benefits

When you spend Rs 5,000 or more within 30 days of the card’s creation, IDFC FIRST Bank Credit Cards give a welcome voucher worth Rs 500 in addition to 5% cashback (up to Rs 1000) on the first EMI transaction made during the same 30-day period.

Complimentary card offers

IDFC FIRST Bank extends credit card offers, including complimentary railway and airport lounge access, roadside assistance, and more.

How do I apply for IDFC First Bank credit cards?

- Click on ‘Apply now’

- Complete the form by filling in all the necessary details

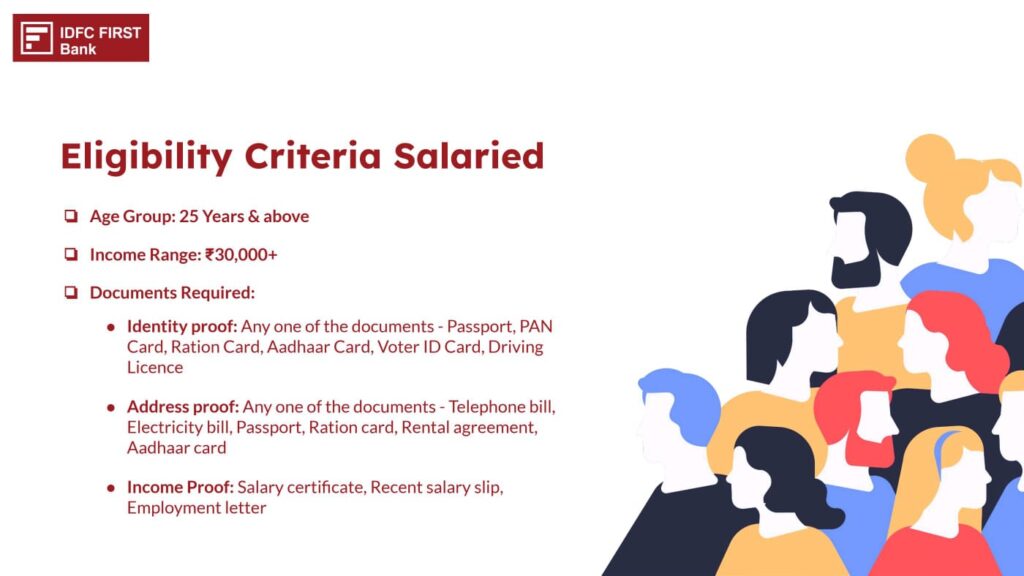

- Upload the needed documents, such as proofs of identity, address, and income

- Review and then submit the application form

Once your application is processed and approved, you will receive your IDFC First Bank Credit Card.

It’s lifetime-free!

IDFC First Bank Credit Cards are loaded with amazing benefits, offers, and features.

You will get:

✅ 10X Rewards that never expire

✅ Interest-free ATM withdrawal (for 48 Days)

✅ Discounts on shopping, dining, and movies

Why you should apply from here:

✔ 100% online process

✔ Minimal documentation

Apply now to get your lifetime credit card. Apply now

Disclaimer

All the information on this website, www.loanhost.in, is published in good faith and for general information purposes only. Loanhost does not make any warranties about the completeness, reliability, or accuracy of this information. Any action you take based on the information you find on this website (loanhost) is strictly at your own risk. Loanhost will not be liable for any losses and/or damages in connection with the use of our website.

From our website, you can visit other websites by following hyperlinks to such external sites. While we strive to provide only quality links to useful and ethical websites, we have no control over the content and nature of these sites. These links to other websites do not imply a recommendation for all the content found on these sites. Site owners and content may change without notice and may occur before we have the opportunity to remove a link that may have gone ‘bad’.

Please also be aware that when you leave our website, other sites may have different privacy policies and terms that are beyond our control. Please be sure to check the privacy policies of these sites as well as their “Terms of Service” before engaging in any business or uploading any information.

Consent

By using our website, you hereby consent to our disclaimer and agree to its terms.

For the latest updates, Please visit the website, https://www.indusind.com